Why Convert from a Single Member LLC to an S-Corp

Although LLCs are all the rage (they do offer a lot a flexibility), converting your Single Member LLC to an S-Corp for tax purposes may result in significant tax savings. Because LLCs are so flexible, you can elect to be taxed as an S-Corp by filing:

- IRS Form 8832: to be classified as a corporation; and

- IRS Form 2553: to be classified as an S-Corporation.

Single Member LLC

An LLC can elect to be taxed as a corporation, as noted above. It can also be taxed as a partnership or as a single member LLC if there is only one member. A single member LLC is considered a “Disregarded Entity” by the IRS. Consequently, income and expenses flow to your Schedule C as if you were a sole proprietor.

As a result, nearly all net income reported by the business is taxed as self-employment income… This could mean upwards of 15% in additional Medicare and Social Security taxes!

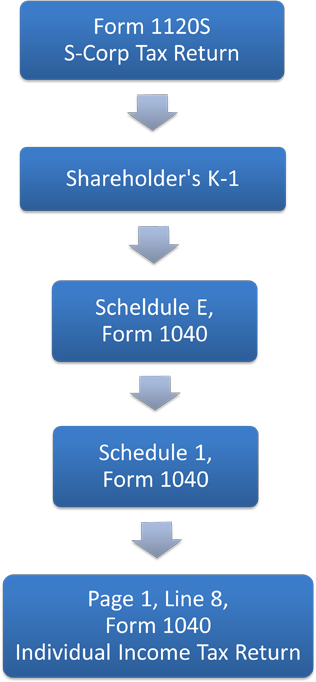

S-Corporation Income Flow

When deciding to convert your Single Member LLC to an S-Corp, your business income and expenses will no longer flow onto your Schedule C… But you will have to file a yearly corporate income tax return using Form 1120S.

However, the s-corporation will NOT pay income tax. (There are exceptions to this rule, but most businesses will not have to worry about that.)

The net income from the S-Corp flows onto your individual income tax return and is combined with any other income (W-2, rental income, interest, etc.). Consequently, you’ll pay the tax on income earned through the business as part of your total individual income tax liability.

Here’s how the income flows:

S-Corp Tax Savings

The IRS requires a reasonable salary to be taken by owner/employees. The S-Corp will deduct your salary as an expense. However, you can still take owner draws even when electing S-Corp status.

The benefit of converting a Single Member LLC to an S-Corp is that you don’t have to pay self-employment taxes (Medicare & Social Security) on the entirety of your net business income.

The trick with S-Corps is to minimize the amount of salary taken to a “reasonable” level and then take the remainder of your pay through distributions. You thereby avoid paying Medicare and Social Security taxes on these distributions.

For example:

Let’s say your business has net income of $100,000 at year end before considering your W-2 salary.

Let’s also say that you need $80,000 to live on.

A reasonable salary could be $35,000. Your business will deduct about $37,700 in Salary and Payroll Taxes:

| Salary: | $ 35,000.00 |

| Payroll taxes: | $ 2,677.50 |

| Total: | $ 37,677.50 |

($35,000 x 0.0765 = $2,677.50)

Your company’s net income is now approximately $62,300 ($100,000 – $37,700) which will flow to your individual tax return and you will pay income taxes on that amount at your individual rate.

Thus, the remaining $45,000 you need to live on can be drawn from the corporation through a Shareholder’s Distribution.

You don’t pay income taxes on this amount because it already has been paid… It’s part of the $62,300 that flows to your individual tax return! The benefit is you avoid having to pay Medicare & Social Security taxes on this $62,300…

A tax savings of about $7,747

(The actual calculation of self-employment tax is more complicated than demonstrated above but I think you get the point! Actual savings depend on taxable income, your tax bracket, and how much reasonable salary you take.)

Keeping an Eye on Shareholder’s Basis

With an S-Corp, it will be important to keep track of your equity account (“Basis”). From the above example, your equity account will have a balance of $17,300 ($62,300 – $45,000). If you draw more than the balance, any excess amount will be taxed at capital gain rates.

Also, any losses cannot be deducted on your individual income tax return in excess of your basis… These losses are NOT lost forever. They’re carried forward to years with a profit.

As you can see, there is a lot to consider with an S-Corp.

But Here’s the Bottom Line…

- Elect to have your LLC treated as an S-Corp for tax purposes.

- Create a personal budget so you have an idea of how much cash you need to live on.

- Have a reasonable salary paid to you by your business.

- Distribute the remaining cash to cover your personal living expenses.

- Keep an eye on your Basis and don’t let it drop below zero.